2018 Medicare Part B Premium Rules

Rules for higher-income beneficiaries

If you have higher income, the law requires an adjustment to your monthly Medicare Part B (medical insurance) and Medicare prescription drug coverage premiums. Higher-income beneficiaries pay higher premiums for Part B and prescription drug coverage. This affects less than five percent of people with Medicare, so most people don’t pay a higher premium.

How does this affect me?

If you have higher income, you’ll pay an additional premium amount for Medicare Part B and Medicare prescription drug coverage. They call the additional amount the income-related monthly adjustment amount. Here’s how it works:

• Part B helps pay for your doctors’ services and outpatient care. It also covers other medical services, such as physical and occupational therapy, and some home health care. For most beneficiaries, the government pays a substantial portion — about 75 percent — of the Part B premium, and the beneficiary pays the remaining 25 percent. If you’re a higher-income beneficiary, you’ll pay a larger percentage of the total cost of Part B based on the income you report to the Internal Revenue Service (IRS). You’ll pay monthly Part B premiums equal to 35, 50, 65, or 80 percent of the total cost, depending on what you report to the IRS.

• Medicare prescription drug coverage helps pay for your prescription drugs. For most beneficiaries, the government pays a major portion of the total costs for this coverage, and the beneficiary pays the rest. Prescription drug plan costs vary depending on the plan, and whether you get Extra Help with your portion of the Medicare prescription drug coverage costs.

Compare Medicare Plans Now

If you’re a higher-income beneficiary with Medicare prescription drug coverage, you’ll pay monthly premiums plus an additional amount, which is based on what you report to the IRS. Because individual plan premiums vary, the law specifies that the amount is determined using a base premium. They tie the additional amount you pay to the base beneficiary premium, not your own premium amount. If you’re a higher-income beneficiary, they deduct this amount from your monthly Social Security payments regardless of how you usually pay your monthly prescription plan premiums. If the amount is greater than your monthly payment from Social Security, or you don’t get monthly payments, you’ll get a separate bill from another federal agency, such as the Centers for Medicare & Medicaid Services or the Railroad Retirement Board.

How does Social Security determine if I must pay higher premiums?

To determine if you’ll pay higher premiums, Social Security uses the most recent federal tax return the IRS provides to them. If you must pay higher premiums, they use a sliding scale to make the adjustments, based on your modified adjusted gross income (MAGI). Your MAGI is your total adjusted gross income and tax-exempt interest income.

If you file your taxes as “married, filing jointly” and your MAGI is greater than $170,000, you’ll pay higher premiums for your Part B and Medicare prescription drug

coverage. If you file your taxes using a different status, and your MAGI is greater than $85,000, you’ll pay higher premiums.

If you must pay higher premiums, they will send you a letter with your premium amount(s) and the reason for their determination. If you have both Medicare Part B and Medicare prescription drug coverage, you’ll pay higher premiums for each. If you have only one — Medicare Part B or Medicare prescription drug coverage — you’ll pay an income-related monthly adjustment amount only on the benefit you have. If you decide to enroll in the other program later in the same year, and you already are paying an income-related monthly adjustment amount, they will apply an adjustment automatically to the other program when you enroll. In this case, they won’t send you another letter explaining how they made this determination.

Remember, if your income isn’t greater than the limits described above, this law does not apply to you.

Which tax return does Social Security use?

To determine your 2018 income-related monthly adjustment amounts, we use your most recent federal tax return the IRS provides to us. Generally, this information is from a tax return filed in 2017 for tax year 2016. Sometimes, the IRS only provides information from a return filed in 2016 for tax year 2015. If they use the 2015 tax year data, and you filed a return for tax year 2016 or did not need to file a tax return for tax year 2016, call them or visit any local Social Security office. They will update their records.

If you amended your tax return, and it changes the income they count to determine the income-related monthly adjustment amounts, let them know. Social Security needs to see a copy of the amended tax return you filed and your acknowledgment receipt from IRS. They will update their records with the information you provide, and correct or remove your income-related monthly adjustment amounts, as appropriate.

Compare Medicare Plans Now

What if my income has gone down?

If your income has gone down due to any of the following situations, and the change makes a difference in the income level we consider, contact us to explain that you have new information and may need a new decision about your income-related monthly adjustment amount:

• You married, divorced, or became widowed;

• You or your spouse stopped working or reduced your work hours;

• You or your spouse lost income-producing property because of a disaster or other event beyond your control;

• You or your spouse experienced a scheduled cessation, termination, or reorganization of an employer’s pension plan; or

• You or your spouse received a settlement from an employer or former employer because of the employer’s closure, bankruptcy, or reorganization

If any of the above applies to you, we need to see documentation verifying the event and the reduction in your income. The documentation you provide should relate to the event and may include a death certificate, a letter from your employer about your retirement, or something similar. If you filed a federal income tax return for the year in question, you need to show us your signed copy of the return. Use Form SSA-44 Medicare Income-Related Monthly Adjustment Amount – Life-Changing Event to report a major life-changing event. If your income has gone down, you may also use Form SSA-44 to request a reduction in your income-related monthly adjustment amount. You can find Form SSA-44 online at www.socialsecurity.gov/forms/ssa-44.pdf.

Monthly Medicare premiums for 2018

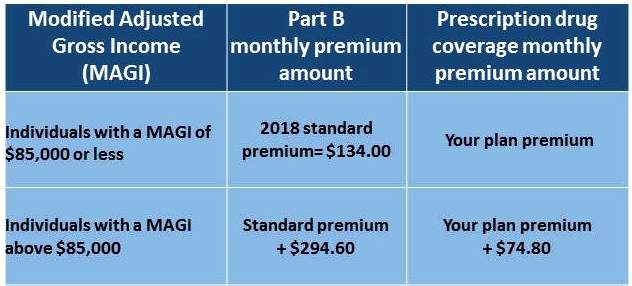

The standard Part B premium for 2018 is $134.00. If you’re single and filed an individual tax return, or married and filed a joint tax return, the following chart applies to you:

If you’re married and lived with your spouse at some time during the taxable year, but filed a separate tax return, the following chart applies to you:

Compare Medicare Plans Now

What if I disagree?

If you disagree with the decision about your income-related monthly adjustment amounts, you have the right to appeal. The fastest and easiest way to file an appeal of your decision is by visiting www.socialsecurity.gov/disability/appeal. You can file online and provide documents electronically to support your appeal. You can file an appeal online even if you live outside of the United States.

You may also request an appeal in writing by completing a Request for Reconsideration (Form SSA-561-U2), or you may contact your local Social Security office to file your appeal. You can find the appeal form online at www.socialsecurity.gov/online or request a copy through our toll-free number at 1-800-772-1213 (TTY 1-800-325-0778). You don’t need to file an appeal if you’re requesting a new decision because you experienced one of the events listed previously, it made your income go down, or if you’ve shown us the information we used is wrong.

If you disagree with the MAGI amount they received from the IRS, you must correct the information with the IRS. If they determine you must pay a higher amount for Medicare prescription drug coverage, and you don’t have this coverage, you must call the Centers for Medicare & Medicaid Services (CMS) at 1-800-MEDICARE (1-800-633-4227; TTY 1-877-486-2048) to make a correction. Social Security receives the information about your prescription drug coverage from CMS. The above information is referenced from this document on the Social Security Administration website.