Medicare Part B Income-Related Monthly Adjustment Amounts

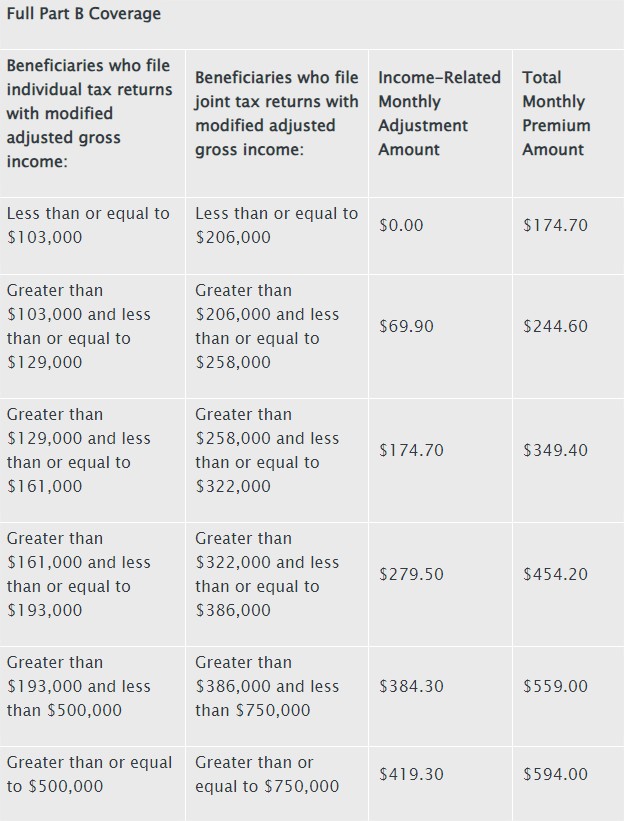

A beneficiary’s monthly Part B premium has been determined by his or her income since 2007. Of those with Medicare Part B, about 8% are affected by these income-related monthly adjustment amounts. The following table displays the total 2024 Part B premiums for high-income beneficiaries with complete Part B coverage:

Compare Medicare Plans Now

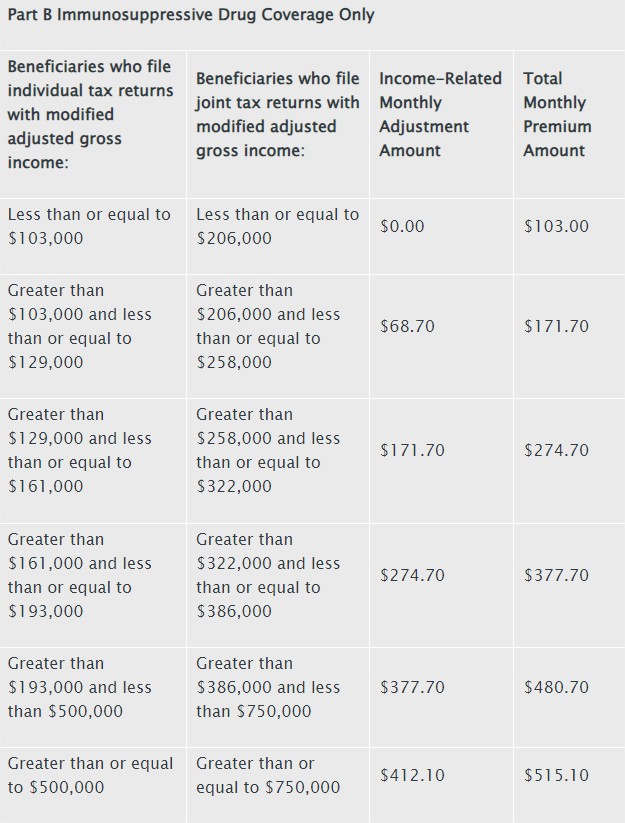

The 2024 Part B total premiums for high-income beneficiaries with immunosuppressive drug only Part B coverage are shown in the following table:

See New Benefits in Your Area

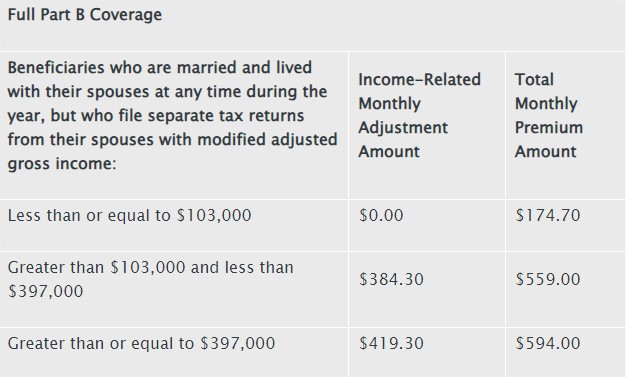

Premiums for high-income beneficiaries with full Part B coverage who are married and lived with their spouse at any time during the taxable year, but file a separate return, are as follows:

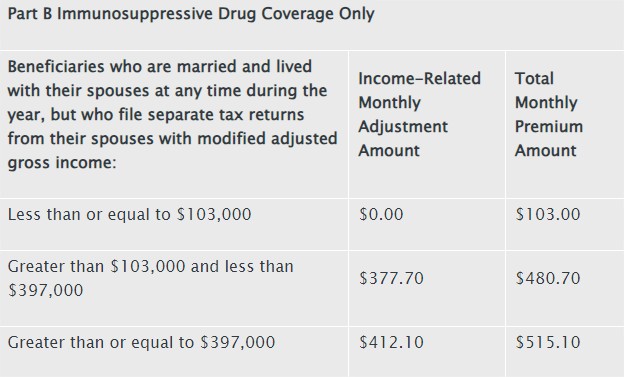

Premiums for high-income beneficiaries with immunosuppressive drug only Part B coverage who are married and lived with their spouse at any time during the taxable year, but file a separate return, are as follows:

See New Plans in Your Area

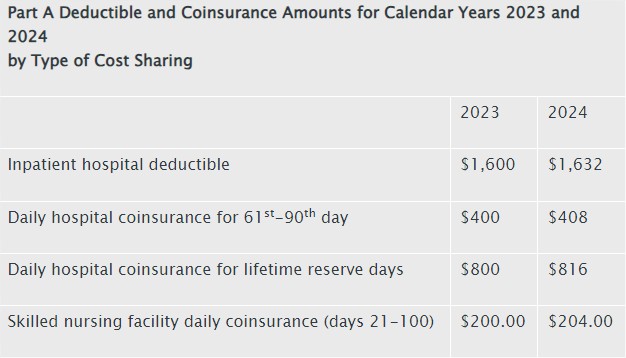

Medicare Part A Premium and Deductible

Inpatient hospitals, skilled nursing facilities, hospice care, inpatient rehabilitation, and certain home health care services are covered under Medicare Part A. According to the Social Security Administration, 99 percent of Medicare recipients do not pay a Part A premium because they have worked for at least 40 quarters in a job that is covered by Medicare.

Medicare Part A inpatient hospital deductibles for beneficiaries will rise by $32 from $1,600 in 2023 to $1,632 in 2024 if they are admitted to the hospital. During the first sixty days of Medicare-supported inpatient hospital care during a benefit period, beneficiaries’ part of costs is covered by the Part A inpatient hospital deductible. In 2024, beneficiaries will be required to pay a coinsurance sum of $816 per day for lifetime reserve days ($800 in 2023) and $408 per day for the 61st through 90th day of a hospitalization ($400 in 2023) during a benefit period. The daily coinsurance for beneficiaries in skilled nursing facilities will be $204.00 in 2024 ($200.00 in 2023) for days 21 through 100 of extended care services during a benefit period.

To voluntarily enroll in Medicare Part A, those 65 years of age or older with less than 40 quarters of coverage, as well as some individuals with impairments, must pay a monthly fee. Part A may be purchased at a discounted monthly premium cost for those who had at least 30 quarters of coverage or who were married to someone who had at least 30 quarters of coverage. In 2024, the monthly premium rate will be $278, which is the same as in 2023. All uninsured seniors with fewer than 30 quarters of coverage and some disabled people who have used up all other available benefits will pay the entire price in 2024, which will drop by $1 from 2023 to $505 per month.

Check out New Plans

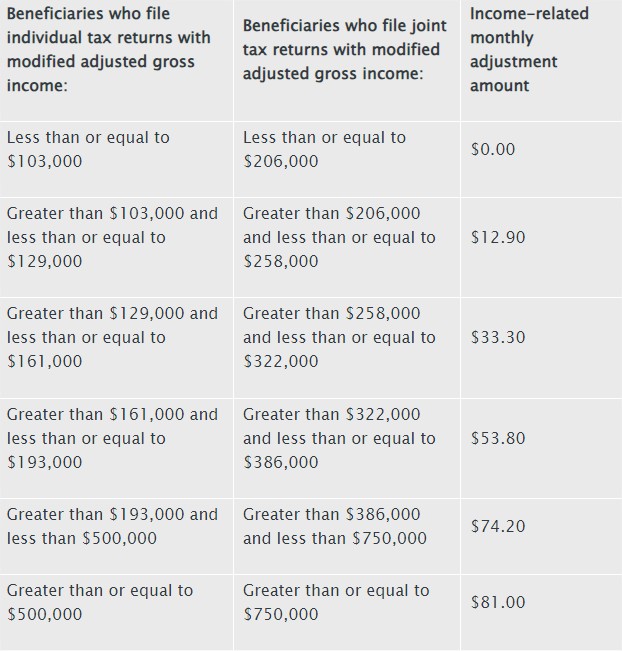

Medicare Part D Income-Related Monthly Adjustment Amounts

A beneficiary’s Part D monthly payment has been determined by his or her income since 2011. The monthly adjustment amounts tied to income affect about 8% of Medicare Part D beneficiaries. These people will pay both their Part D premium and the income-related monthly adjustment amount. Part D premiums vary per plan, and the Part D income-related monthly adjustment amounts are withdrawn from Social Security benefit checks or paid directly to Medicare, whatever method a beneficiary chooses to pay their Part D premium. The majority of beneficiaries have their premiums deducted from their Social Security benefit checks, with the other recipients paying premiums directly to the plan. The following table displays the 2024 Part D income-related monthly adjustment levels for high-income beneficiaries:

Compare Medicare Plans Now

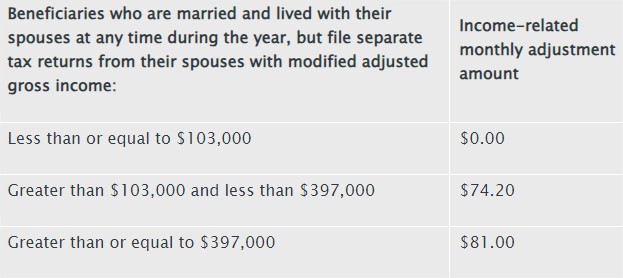

Premiums for high-income beneficiaries who are married and lived with their spouse at any time during the taxable year, but file a separate return, are as follows:

If you have any questions, you can contact a Medicare Health Plan Specialist at 877-413-1556.