What Is a Medicare HMO Plan?

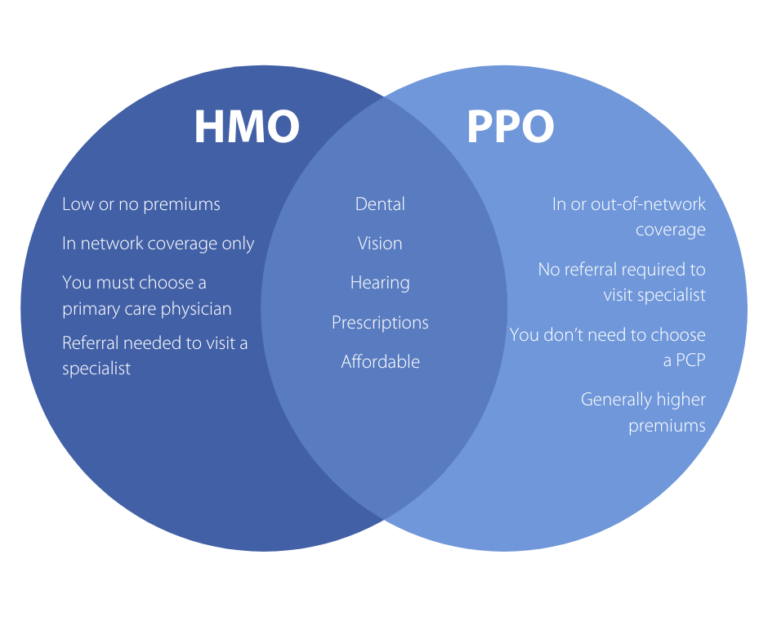

A Health Maintenance Organization (HMO) Plan is one of the most popular types of Medicare Advantage (Part C) plans. It provides comprehensive healthcare coverage through a network of approved doctors and facilities—often at lower out-of-pocket costs than other plan types.

With an HMO Plan, you must typically:

Use doctors and hospitals within the plan’s network

Get a referral from your primary care provider (PCP) to see a specialist

Enroll in both Medicare Part A and Part B

Most HMO plans also include Medicare Part D prescription drug coverage and may offer additional benefits such as:

Dental and vision care

Hearing services

Fitness memberships

Wellness programs

How Do Medicare HMO Plans Work?

If you join an HMO Medicare Advantage Plan:

You’ll continue paying your Medicare Part B premium, and possibly a small monthly plan premium (some are $0)

You must use in-network providers for non-emergency care

Emergency and urgent care are covered nationwide, even outside your service area

Your out-of-pocket costs (like copayments and coinsurance) vary depending on the plan

Plan availability, costs, and covered services can differ widely depending on where you live and which insurer you choose.

Who Should Consider an HMO Plan?

An HMO Plan might be a good choice if you:

Want a lower-cost Medicare Advantage option

Don’t mind working within a provider network

Prefer coordinated care from a single primary doctor

Take few prescriptions or have access to a solid drug formulary in the plan

If you travel frequently or prefer provider flexibility, a PPO or PFFS Plan may be more suitable.

Important Considerations Before Enrolling

Medigap Incompatibility

If you join an HMO plan, any Medigap (Medicare Supplement) coverage you have will no longer pay your deductibles, copays, or coinsurance.

Although you may keep your Medigap policy, it won’t coordinate with your Medicare Advantage coverage.

Coverage Areas

HMO plans are regional, meaning what’s available in one zip code may not be offered in another.

You can check plan availability at Medicare.gov or by contacting a MedicareMall expert.

Why Choose MedicareMall?

At MedicareMall, we help you compare HMO plans in your area, explain coverage and cost differences, and assist with enrollment. With over two decades of experience, our licensed representatives can help you:

Avoid hidden fees or surprise costs

Understand the pros and cons of each plan type

Determine whether a plan includes your preferred doctors and prescriptions

Enroll over the phone in just a few minutes

Choosing the right Medicare Advantage plan doesn’t have to be overwhelming—let us help you simplify the process.