Understanding Medicare: A Complete Overview

Medicare can feel overwhelming, but it doesn’t have to be. Let’s break it down simply so you can make confident decisions about your healthcare.

A Brief History

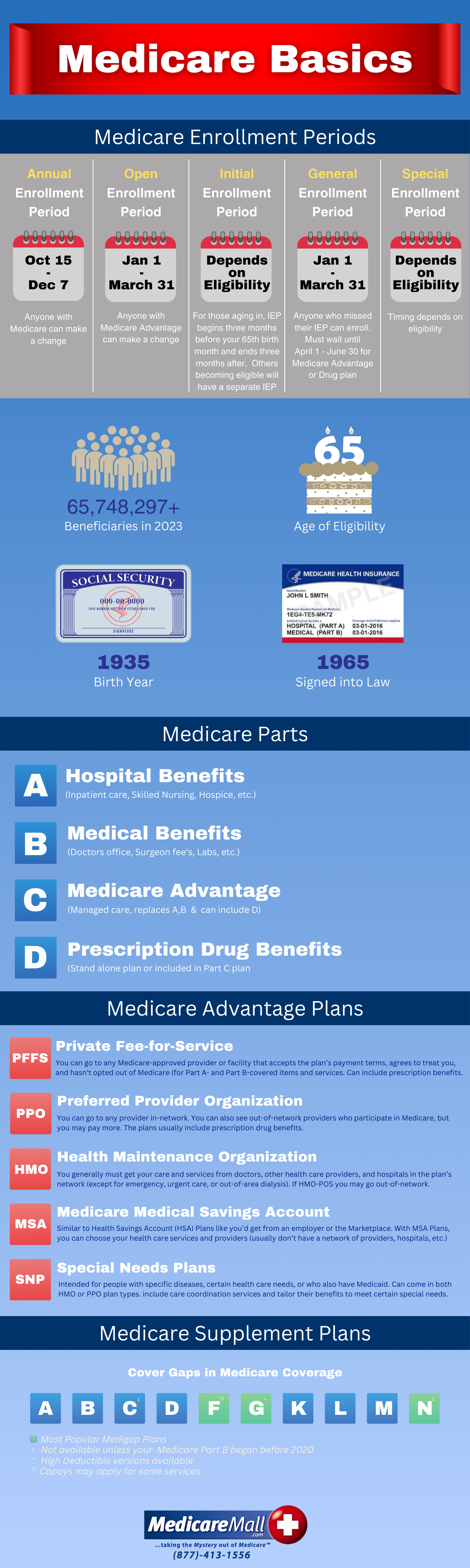

Medicare was established in 1965 to provide healthcare coverage to Americans aged 65 and older. Today, it also covers younger individuals with disabilities and those with end-stage renal disease. The original program included Part A (hospital insurance) and Part B (medical insurance). Later, Parts C (Medicare Advantage) and D (prescription drug coverage) were added.

Medicare Enrollment Basics

Initial Enrollment Period

You’re eligible to enroll in Medicare starting three months before the month you turn 65, lasting until three months after. Enroll early to avoid delays. If your birthday is on the 1st, your coverage starts the month before you turn 65.

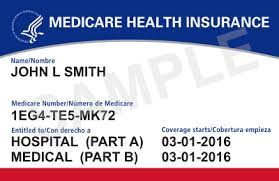

Applying for Medicare

You can apply for Medicare and Social Security benefits at ssa.gov. Enrollment is automatic if you’re already receiving Social Security.

Medicare Part A – Hospital Insurance

Covers:

-

Inpatient hospital stays

-

Skilled nursing facility care (post-hospital stay)

-

Home health care

-

Hospice care

Costs:

-

Premium: Free for most with 10+ years of work history

-

Deductible: Per benefit period (not annually)

-

Coinsurance: Applies after 60 hospital days

Medicare Part B – Medical Insurance

Covers:

-

Doctor visits, outpatient care, lab tests, preventive services

-

Durable medical equipment

-

Mental health and therapy services

-

Telehealth and diagnostic testing

Costs:

-

Monthly premium required

-

Annual deductible

-

Covers 80% of approved services (you’re responsible for the rest unless you have supplemental coverage)

Important: If you skip Part B when first eligible and don’t have other creditable coverage, you may face a late enrollment penalty.

Medicare Part C – Medicare Advantage

Medicare Advantage (Part C) is an all-in-one alternative to Original Medicare. Offered by private companies, these plans include Part A and B coverage, and often dental, vision, hearing, and prescription drugs.

Types of Plans:

-

HMO: Requires in-network doctors and referrals

-

PPO: More flexibility with out-of-network providers

-

PFFS, HMO-POS, MSA, SNPs: Specialized plan types for different needs

Costs & Access:

-

Fixed monthly Medicare payment to provider

-

Lower out-of-pocket costs, but network rules apply

Enrollment:

- Doctor visits, outpatient care, lab tests, preventive services

- Durable medical equipment

- Mental health and therapy services

- Telehealth and diagnostic testing

Costs:

- Monthly premium required

- Annual deductible

- Covers 80% of approved services (you’re responsible for the rest unless you have supplemental coverage) Important: If you skip Part B when first eligible and don’t have other creditable coverage, you may face a late enrollment penalty.

Medicare Part D – Prescription Drug Coverage

Covers:

-

Both brand-name and generic prescription medications

Standalone Plans or Included in Part C

-

Late enrollment penalties may apply if you don’t have creditable drug coverage

-

Includes phases such as initial coverage, coverage gap (donut hole), and catastrophic coverage

Medigap (Medicare Supplement Insurance)

Medigap plans help cover costs that Original Medicare doesn’t, such as deductibles, coinsurance, and copayments. There are 10 standardized plans: A, B, C, D, F, G, K, L, M, and N.

Popular Plans:

-

Plan G: Broad coverage except Part B deductible

-

Plan N: Lower premiums with some cost-sharing

-

Plan F: Only available to those eligible before 2020

Enrollment Tip: You have a guaranteed right to buy any Medigap policy within 6 months of enrolling in Part B if you’re 65 or older.

Next Steps

Use our MedicareMall Quote Finder to compare plans and prices in your area. Our team is here to help guide you through your Medicare journey, ensuring peace of mind and long-term savings.