What Are Medicare Supplement Plans?

Medicare Supplement Insurance, also known as Medigap, helps cover out-of-pocket costs left behind by Original Medicare (Parts A and B). These may include:

Part A deductibles and coinsurance

Part B coinsurance and copays

Skilled nursing facility coinsurance

Emergency medical care during foreign travel

Medigap plans are standardized and regulated by the federal government, which means Plan G from one provider offers the same benefits as Plan G from another—only the monthly premiums and customer service vary.

Medigap Options in Arizona for 2025

As of 2025, there are dozens of Medigap plan options available to Arizona residents, provided by major insurance carriers including:

AARP/UnitedHealthcare

Aetna

Blue Cross Blue Shield of Arizona

Cigna

Humana

Mutual of Omaha

Globe Life

Medico

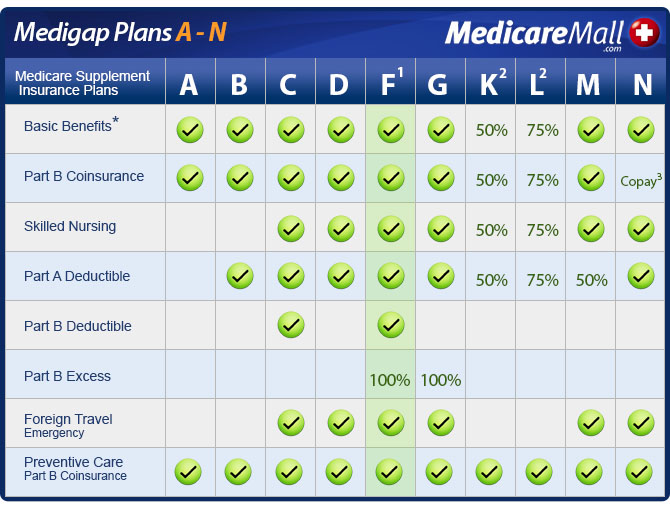

You can choose from 10 standardized Medigap plans (Plans A, B, C, D, F, G, K, L, M, N) plus High-Deductible Plan G and, if eligible, High-Deductible Plan F

2025 Arizona Medigap Premium Ranges

Premiums for Medigap policies vary based on age, gender, location, and tobacco use. In Arizona, here are estimated 2025 monthly premiums:

Plan G: $92 – $390

Plan N: $78 – $320

High-Deductible Plan G: $29 – $180

Plan F: $110 – $470 (only for those eligible before 2020)

These plans help limit out-of-pocket costs for Arizona beneficiaries, especially when managing chronic conditions or unexpected medical events.

Key Plan Features to Know

High-Deductible Plan F: In 2025, this plan has a deductible of $2,800 before benefits kick in.

Plan K: Once you reach $7,060 in out-of-pocket costs, it pays 100% of covered services.

Plan L: Caps out-of-pocket spending at $3,530 in 2025.

Plan N: You pay up to $20 per office visit and $50 for ER visits (waived if admitted).

All Medigap plans work nationwide, as long as the provider accepts Medicare.

Why Choose a Medicare Supplement Plan in Arizona?

While Original Medicare covers a lot, it still leaves behind:

Deductibles

20% coinsurance on doctor visits and outpatient care

No limit on annual out-of-pocket costs

Medicare Supplement plans help fill those gaps, offering financial protection and peace of mind.

Whether you’re on a fixed income or simply want comprehensive coverage, Medigap is a strong solution for Arizona seniors.

How MedicareMall Can Help

MedicareMall is your trusted resource for comparing and enrolling in Arizona Medigap plans. Our licensed agents:

Compare quotes from top carriers

Assess your health and eligibility

Help you understand your options

Provide personalized support, not pushy sales

Get Your Free Medigap Quote Now

Or call us at (877) 413-1556 to speak with an Arizona Medigap expert.