Key Points about Popular Medigap Insurance Plans:

- Reputation and Trust: Popular Medicare Supplement insurance companies are well-known and have established a reputation for reliability and customer service. They have built trust among beneficiaries due to their track record of delivering on their promises and providing timely support when needed.

- Nationwide Coverage: These companies typically offer coverage in multiple states across the United States. This wide geographic reach allows them to serve a large number of Medicare beneficiaries, ensuring access to their plans for people living in different regions.

- Variety of Plans: Popular Medicare Supplement insurance companies often offer a wide range of standardized plans. These plans, labeled with letters such as Plan A, Plan B, Plan F, etc., are regulated by the government and provide consistent benefits, regardless of the company selling them.

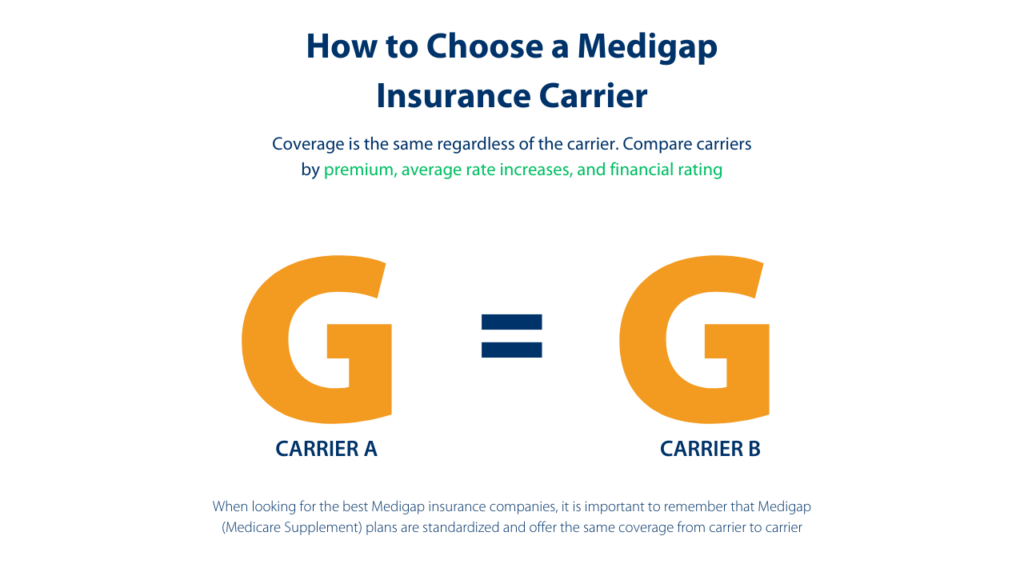

Standardization of Plans:

The standardized plans offered by Medicare Supplement insurance companies are regulated by the government. This means that each plan, regardless of the company selling it, must offer the same set of benefits. For example, Plan F from Company A will have the same benefits as Plan F from Company B. Standardization ensures that beneficiaries can easily compare plans and make informed decisions based on coverage and pricing.

Comparison between Companies:

Medicare supplement insurance companies are not all the same. Some are seriously committed, while others dabble in this space. There are many companies that make Medicare supplement insurance one of their primary focuses. It’s not unusual to hear about a company that you’ve never heard of before. Less-known companies might be more niche-focused, providing specialized plans or personalized customer service. They may also offer additional benefits and perks due to their commitment to the business line. However, beneficiaries should research and compare the financial stability and customer reviews of any company they are considering.

Enrollment and Underwriting Differences:

Enrollment periods for Medicare Supplement plans may vary by state and company, but there are two significant periods to be aware of:

- Initial Enrollment Period (IEP): The IEP begins when a person is both 65 or older and enrolled in Medicare Part B. During this time, they have guaranteed issue rights, which means the insurance company cannot deny coverage or charge higher premiums based on health conditions.

- Open Enrollment Period (OEP): The OEP is a one-time six-month period that begins when a person is both 65 or older and enrolled in Medicare Part B. During this period, beneficiaries have guaranteed issue rights for Medicare Supplement plans.

Underwriting differences may occur at other times outside the IEP or OEP. Some companies may require medical underwriting, meaning they can consider an applicant’s health status when deciding to offer coverage or setting premiums. Other companies might have more lenient underwriting policies, offering coverage without medical underwriting even outside of the IEP or OEP.

FAQs about Medicare Supplement Insurance:

- What is Medicare Supplement insurance? Medicare Supplement insurance, also known as Medigap, is private health insurance that helps cover the “gaps” in Medicare Part A and Part B coverage, such as deductibles, coinsurance, and copayments.

- How does Medigap differ from Medicare Advantage? Medigap plans work alongside Original Medicare, providing additional coverage for out-of-pocket expenses. Medicare Advantage plans, on the other hand, replace Original Medicare and often include prescription drug coverage and additional benefits.

- Are Medigap plans standardized? Yes, Medigap plans are standardized, which means each plan offers the same set of benefits, regardless of the insurance company selling it.

- Can I purchase a Medigap plan if I have a pre-existing condition? During your Initial Enrollment Period or certain guaranteed issue situations, insurance companies cannot deny you coverage or charge more based on pre-existing conditions.

- Are prescription drugs covered by Medigap plans? No, Medigap plans do not cover prescription drugs. If you want prescription drug coverage, you’ll need to enroll in a separate Medicare Part D plan.

- Can I use my Medigap plan outside of the United States? Some Medigap plans provide limited coverage for emergency care during foreign travel. Check the specific plan details to understand the coverage when traveling internationally.

- Can I change my Medigap plan anytime? You can change your Medigap plan at any time, but you may be subject to medical underwriting if you’re outside your Initial Enrollment Period or a guaranteed issue situation.

- Do Medigap plans cover dental or vision care? Medigap plans do not typically cover routine dental or vision care. You may need to purchase standalone dental and vision insurance for those services.

- Can my Medigap plan be canceled by the insurance company? As long as you pay your premiums on time, your Medigap plan cannot be canceled by the insurance company, regardless of your health status.

- Can I have both a Medicare Advantage plan and a Medigap plan? No, it is illegal for an insurance company to sell you both a Medicare Advantage plan and a Medigap plan. You must choose one or the other.

Three Takeaways:

- Popular Medicare Supplement insurance companies are trusted, established, and offer a variety of standardized plans, ensuring consistent benefits for beneficiaries.

- Medicare Supplement plans are standardized, allowing beneficiaries to easily compare plans based on coverage and pricing, regardless of the insurance company selling them.

- When choosing between big and smaller companies, consider factors such as financial stability, customer service, and coverage options. Research and compare before making a decision, and be aware of enrollment and underwriting differences for Medigap plans.