Navigating healthcare costs in retirement can be challenging. If you’re enrolled in Original Medicare (Parts A and B), you might find that it doesn’t cover all your medical expenses. That’s where Medicare Supplement Insurance, commonly known as Medigap, comes into play. For residents of Iowa, understanding your Medigap options is crucial to ensure comprehensive healthcare coverage.

What Is Medigap?

Medigap is private health insurance designed to supplement Original Medicare. It helps cover “gaps” such as:

Part A deductibles and coinsurance

Part B coinsurance and copayments

Skilled nursing facility care coinsurance

Foreign travel emergency care

It’s important to note that Medigap plans do not cover:

Prescription drugs (you’ll need a separate Part D plan)

Routine dental, vision, or hearing care

Long-term care

Available Medigap Plans in Iowa

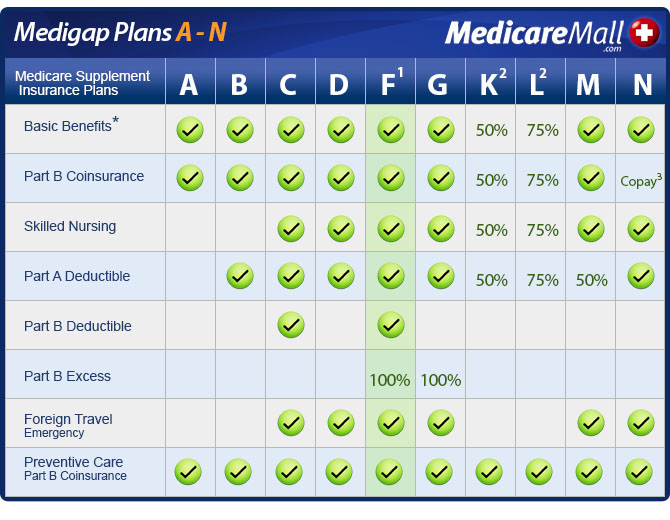

In Iowa, you have access to 12 standardized Medigap plans: A, B, C, D, F, G, K, L, M, N, and high-deductible versions of F and G. Each plan offers a different level of coverage, but the benefits of each plan type are the same across all insurance companies. However, premiums can vary based on the insurer and other factors.

2025 Medigap Premium Ranges in Iowa

Premiums for Medigap plans in Iowa vary based on age, gender, tobacco use, and the specific plan chosen. Here’s a snapshot of the monthly premium ranges for 2025:

Plan F: $104 – $496

Plan G: $87 – $430

Plan N: $67 – $339

High-Deductible Plan G: $30 – $244

High-Deductible Plan F: $31 – $165

Note: Plan F is only available to those who were eligible for Medicare before January 1, 2020.

Top Medigap Providers in Iowa

Several reputable insurance companies offer Medigap plans in Iowa, including:

Each provider may offer different premiums and additional benefits, so it’s essential to compare plans to find the best fit for your needs.

Enrollment Periods and Eligibility

The Medigap Open Enrollment Period is a six-month window that begins the month you’re both 65 or older and enrolled in Medicare Part B. During this period:

You have a guaranteed right to purchase any Medigap policy sold in your state.

Insurance companies cannot deny you coverage or charge higher premiums due to pre-existing conditions.

If you miss this window, you may still apply for a Medigap policy, but insurers can use medical underwriting, which might affect your eligibility and premium costs.

Prescription Drug Coverage

Medigap plans sold after 2005 do not include prescription drug coverage. To obtain this coverage, you should enroll in a standalone Medicare Part D plan. In Iowa, there are 16 Part D plans available, with premiums ranging from $0 to $122.30 per month. The average monthly premium is approximately $57.21.

Assistance and Resources in Iowa

For personalized assistance and more information:

Iowa SHIIP (Senior Health Insurance Information Program): shiip.iowa.gov | Phone: 1-800-351-4664

Medicare: www.medicare.gov | Phone: 1-800-MEDICARE (1-800-633-4227)

Get a Free Medigap Quote Today

Understanding your healthcare coverage is vital. If you’re considering a Medigap plan in Iowa, now is the time to explore your options. Contact us today to receive a free, no-obligation quote and find the plan that best suits your healthcare needs and budget.