What Is Medicare Supplement Insurance?

Medicare Supplement Insurance, also known as Medigap, helps cover the costs that Original Medicare (Part A and Part B) doesn’t fully pay—such as deductibles, coinsurance, and copayments. These plans provide important financial protection, especially for seniors who want to limit their out-of-pocket exposure.

2025 Medigap Options in Maine

As of 2025, 10 insurance companies offer standardized Medicare Supplement (Medigap) plans to Maine residents. These include popular carriers like:

AARP/UnitedHealthcare

Mutual of Omaha

Aetna

Humana

Cigna

Anthem Blue Cross Blue Shield of Maine

Globe Life

Medico

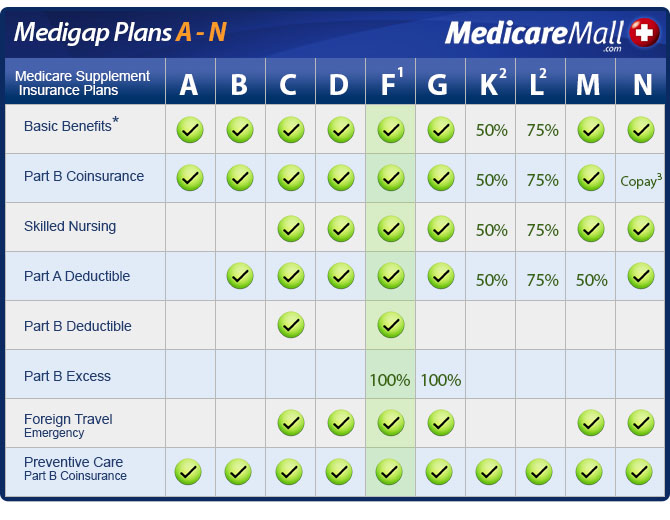

You can choose from Plans A, B, D, G, K, L, M, and N, as well as High-Deductible Plan G. Plan F and C are only available to those who were eligible for Medicare before January 1, 2020.

2025 Medigap Premium Estimates in Maine

Medigap premiums vary based on age, tobacco use, and zip code. Here’s a general range of monthly premiums in Maine for 2025:

Why Choose a Medigap Plan?

Original Medicare leaves behind significant cost-sharing:

Part A deductible ($1,632 per benefit period in 2025)

Part B deductible ($240 in 2025)

20% coinsurance on Part B services

No cap on annual out-of-pocket costs

A Medigap plan helps you pay those costs—and with the right plan, you may have very little or even zero out-of-pocket expenses for Medicare-approved services.

Important Plan Details for 2025

High-Deductible Plan G: Requires a $2,800 deductible before coverage begins.

Plan K: Pays 50% of most costs until you reach a $7,220 out-of-pocket max.

Plan L: Pays 75% of costs until you hit a $3,610 out-of-pocket max.

Plan N: Includes $20 copays for doctor visits and $50 for ER visits (waived if admitted).

How MedicareMall Can Help

MedicareMall works with all top-rated Medigap providers in Maine and compares rates daily to help you find the most affordable plan. Our licensed and bonded specialists will:

Guide you through plan selection

Explain enrollment options and timelines

Help you avoid medical underwriting when possible

Make sure your transition into coverage is seamless