What Is Medicare Supplement Insurance?

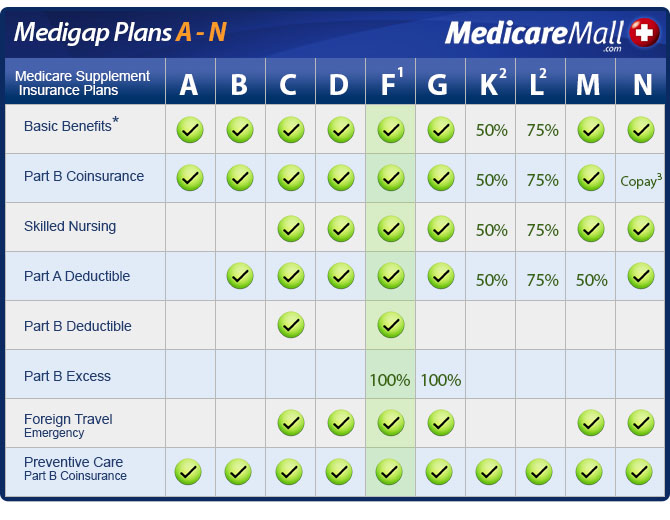

Medicare Supplement Insurance—commonly known as Medigap—helps cover costs that Original Medicare (Parts A and B) doesn’t fully pay. These plans help reduce or eliminate your out-of-pocket costs for:

Part A deductibles and coinsurance

Part B coinsurance and copayments

Emergency care while traveling abroad

Skilled nursing facility care coinsurance

All Medigap plans are standardized by the federal government, which means Plan G offers the same benefits no matter which company you choose—only premiums and customer service vary.

2025 Medigap Options in Maryland

As of 2025, 13 insurance companies offer Medicare Supplement Insurance plans in Maryland. These include:

AARP/UnitedHealthcare

Mutual of Omaha

Cigna

Anthem/BCBS

Aetna

Humana

Globe Life

Medico

ManhattanLife

Transamerica

…and more

These companies offer access to standardized Medigap plans, including:

Plans A, B, D, G, K, L, M, N

High-Deductible Plan G

Plan F and High-Deductible Plan F (available only to those eligible for Medicare before January 1, 2020)

Estimated 2025 Medigap Premiums in Maryland

Medigap premiums vary depending on your age, zip code, gender, and tobacco use. Below are estimated monthly ranges in Maryland:

Plan G: $100 – $370

Plan N: $80 – $285

High-Deductible Plan G: $35 – $160

Plan F: $115 – $425 (for those eligible before 2020)

Why Choose a Medigap Plan?

Original Medicare leaves you responsible for major out-of-pocket costs:

$1,632 Part A deductible (per benefit period in 2025)

$240 Part B deductible

20% coinsurance for most doctor visits, outpatient care, and medical equipment

No annual limit on out-of-pocket expenses

Medigap plans help fill those gaps, offering greater financial security—especially for Maryland seniors on a fixed income.

Important 2025 Plan Features

High-Deductible Plan G: Has a $2,800 deductible in 2025 before coverage begins.

Plan K: Covers 50% of most costs until you reach the $7,220 out-of-pocket limit.

Plan L: Covers 75% of most costs until you reach the $3,610 out-of-pocket limit.

Plan N: Requires $20 copays for office visits and $50 for ER visits (waived if admitted).

How MedicareMall Helps Maryland Residents

MedicareMall has worked with Maryland seniors for over 20 years, offering free guidance and personalized plan comparisons. We:

Work with all major Medigap providers in Maryland

Shop rates across the state

Ensure smooth enrollment

Offer expert insights into Medigap vs. Medicare Advantage