Understanding Medicare Supplement Plans in Massachusetts

Unlike most states, Massachusetts uses its own standardized structure for Medicare Supplement (Medigap) plans. Rather than Plans A–N, Massachusetts residents have access to:

Core Plan

Supplement 1 Plan (available only to those eligible before January 1, 2020)

Supplement 1A Plan

These plans are designed to help cover costs left behind by Original Medicare (Parts A & B) such as:

Deductibles

Coinsurance and copayments

Extended hospital coverage

Skilled nursing facility care

Emergency care while traveling abroad

All plans are standardized by the state and federally regulated, ensuring consistent coverage regardless of which insurer you choose.

Who Offers Medigap Plans in Massachusetts (2025)?

As of 2025, the following major insurance carriers offer Medicare Supplement plans in Massachusetts:

Blue Cross Blue Shield of Massachusetts

Harvard Pilgrim Health Care

Tufts Health Plan

AARP/UnitedHealthcare

Humana

Mutual of Omaha

Overview of Massachusetts Medigap Plan Options

Core Plan

Basic benefits

Pays Part A coinsurance and additional hospital costs

Pays some Part B coinsurance and hospice care

Does not cover Part A/B deductibles or excess charges

Supplement 1 Plan

(Only available to individuals eligible for Medicare before January 1, 2020)

Covers nearly all Medicare out-of-pocket costs, including the Part B deductible

Most comprehensive coverage available

Supplement 1A Plan

Covers everything Supplement 1 does except the Part B deductible

Available to all Medicare beneficiaries, regardless of eligibility year

2025 Estimated Monthly Premiums in Massachusetts

Medigap premiums vary by insurer, but here are average monthly premium ranges for 2025:

Core Plan: $127 – $178/month

Supplement 1 Plan: $196 – $298/month

Supplement 1A Plan: $182 – $287/month

Why Massachusetts Plans Are Different

Massachusetts is one of only three states (along with Minnesota and Wisconsin) that uses state-specific Medigap plan structures, offering simplicity and broad coverage in streamlined options.

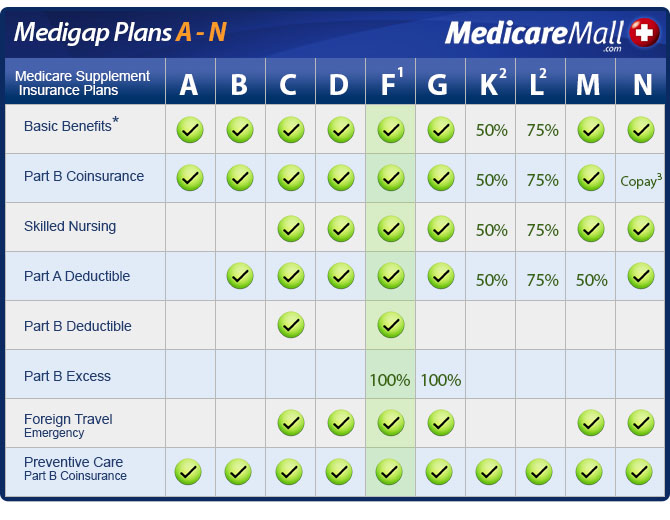

You won’t find Plans G, N, F, or High-Deductible F in Massachusetts as they are not offered here.

How MedicareMall Can Help

If you’re exploring your Massachusetts Medigap options, MedicareMall is here to help. Our licensed and bonded team:

Compares plans from multiple carriers

Helps determine eligibility for Supplement 1

Offers personalized quotes with no obligation

Ensures your transition to Medicare coverage is smooth and secure