Once a person is eligible for Medicare and has signed up for Medicare Part B, he or she should investigate Medicare Supplement Insurance Plans that will help cover medical costs not covered by Original Medicare Part A and Medicare Part B.

We here at MedicareMall believe Medigap insurance plans offer the best options for senior health insurance. All Medigap plans were standardized by the federal government for your protection in 1992. This means, for example, that a Medicare Supplement Plan F purchased from Mutual of Omaha will pay the same benefits as a Medigap Plan F purchased from Blue Cross and Blue Shield.

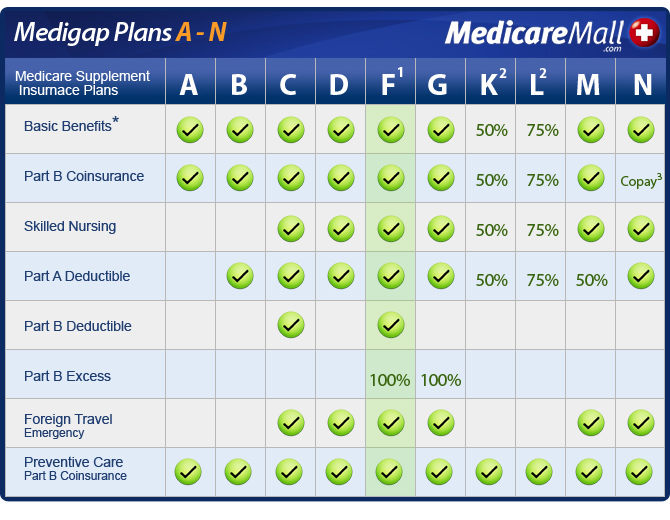

The chart below highlights the benefits of standardized Medicare supplemental insurance plans A through N taking effect on or after June 1, 2010. Plans taking effect prior to that date pay different benefits.

Although Plans E, H, J, and I are no longer sold and some of the remaining plans may not be available in your state, every Medicare supplement insurance company must make Medigap Plan A available to everyone who is eligible for Medicare.

Basic benefits include

Hospitalization: Medicare Part A coinsurance plus coverage for 365 additional days after Medicare benefits end.

Medical Expenses: Medicare Part B coinsurance (generally 20% of Medicare-approved expenses) or copayments for hospital outpatient services. (Medicare Supplement Insurance Plans K, L, and N require insured persons to pay a portion of Medicare Part B coinsurance or copayments.)

Blood: Your first three pints of blood each year.

Hospice Care: Medicare Part A coinsurance.

Click on any of the links below to learn more about Medicare supplement plans A through N. Once you have had a chance to look over the benefits these individual plans provide, chances are you will have an idea, which plan or plans may work for you.

Most seniors are on a fixed income and certainly do not want to be hit with unexpected medical expenses if and when their health changes. There are no guarantees in life, but Medicare supplement plans can go a long way toward minimizing risk and seeing that more of your hard-earned money stays in your pocket. Contact MedicareMall now and we will help you find the very best Medicare supplementary insurance to meet your needs and budget.

* Basic Benefits include:

Hospitalization– Part A coinsurance plus coverage for 365 additional days after Medicare benefits end.

Medical Expenses– Part B coinsurance (generally 20% of Medicare-approved expenses) or copayments for hospital outpatient services. Plans K, L, and N require insureds to pay a portion of Part B coinsurance or copayments.

Blood– First 3 pints of blood each year.

Hospice– Part A coinsurance.

- Plan F may be offered with a high-deductible option of $2,200. The benefits are the same as in the standardized plan, but the deductible must be met each year before any claims are paid.

- After you have paid out-of-pocket expenses for plan K ($5,120) or L ($2,560) for covered benefits during a calendar year, the plan will pay 100% of covered benefits for the remainder of that year. The Part B deductible ($183 in 2017) is not a covered benefit but counts toward the out-of-pocket limit. Part B excess charges are not a covered benefit and their payment does not count toward the out-of-pocket limit.

- You pay up to $20 for each office visit. Plan N pays the remainder of any Part B approved coinsurance charges. The office visit copayment applies to all office visits by any provider authorized to bill Medicare for those visits. There is no annual limit on this copayment, and it must be paid for each office visit, even if you have several visits on the same day. The copayment for emergency room use is waived only if you are admitted to a hospital and Medicare covers the ER visit under Part A.

Once a person is eligible for Medicare and they have signed up for Medicare Part B they now should find a Medicare Supplement Insurance Plans that will pay the benefits not covered by original Medicare Part A & Medicare Part B.

We here at MedicareMall believe that Medigap Insurance Plans offer the best options for senior health insurance. All plans were standardized by the Federal Government for your protection in 1992. This means that you to go by the letter ID of the Medigap plan for Medicare benefits. If you purchase a Medicare Supplement Plan F from Mutual of Omaha, than the Medigap Plan F from Blue Cross/Blue Shield has the same Medigap benefits and will pay the same amounts.

The chart highlights the benefits of Standardized Medicare Supplement Insurance Plans A – N ( A, B, C, D, F, G, K, L, M and N ). Every Medicare Supplement Insurance Company must make available Medigap Plan A. Some Medigap plans may not be available in your state. Medicare Supplement Insurance Plans E, H, I, and J are no longer available for sale. Medigap plans K and L are structured a bit differently; they are both high-deductible Medicare Supplement Insurance Plans and cover 50% (Medigap Plan K) or 75% (Medigap Plan L) of the marked benefits below.

The Medicare Supplement Insurance Plans chart below shows benefits of policies sold for effective dates on or after June 1st, 2010. Medicare Supplement Insurance Plans sold for effective dates prior to June 1st, 2010, have different benefits.

*Basic Benefits Include:

- Hospitalization: Medicare Part A coinsurance plus coverage for 365 additional days after Medicare benefits end.

- Medical Expenses: Medicare Part B coinsurance (generally 20% of Medicare-approved expenses) or copayments for hospital outpatient services. Medicare Supplement Insurance Plans K, L, and N require insureds to pay a portion of Medicare Part B coinsurance or copayments.

- Blood: First 3 pints of blood each year. Hospice: Medicare Part A coinsurance.

1. Medicare Supplement Insurance Plan F may be offered with a high-deductible option of $2,200. The benefits are the same as in the standardized Medicare Supplement Insurance Plans, but the deductible must be met each year before any claims are paid.

2. After you have paid out-of-pocket expenses for Medigap plan K ($5,120) or Medigap plan L ($2,560) for covered benefits during a calendar year, the plan will pay 100% of covered benefits for the remainder of that year. The Medicare Part B deductible ($140 in 2012) is not a covered benefit but counts toward the out-of-pocket limit. Medicare Part B excess charges are not a covered benefit and their payment does not count toward the out-of-pocket limit.

3. You pay up to $20 for each office visit. Medigap Plan N pays the remainder of any Medicare Part B approved coinsurance charges. The office visit co-payment applies to all office visits by any provider authorized to bill Medicare for those visits. There is no annual limit on this co-payment and it must be paid for each office visit, even if you have several visits on the same day. The co-payment for emergency room use is waived only if you are admitted to a hospital and Medicare covers the ER visit under Part A.

When deciding on what Medicare Supplement Insurance Plans is best for you take into consideration that you’re most likely on a fixed income and you do not want to have any unexpected medical expenses if and when your health changes. Remember today you are healthy but our health can turn on a dime.

For more information click on the Medicare Supplement Insurance Plans below: