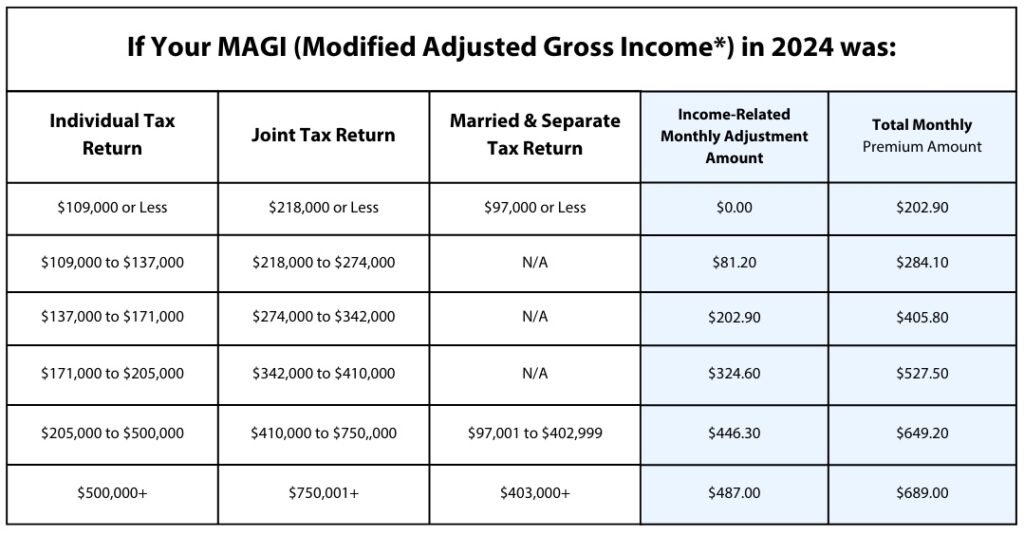

Medicare Part B Income-Related Monthly Adjustment Amounts

Since 2007, a beneficiary’s Part B monthly premium has been based on his or her income. These income-related monthly adjustment amounts affect roughly 8% of people with Medicare Part B. The 2026 Part B total premiums for high-income beneficiaries with full Part B coverage are shown in the following table:

2026 Medicare Part B IRMAA

Income-Related Monthly Adjustment Amount

Part B Immunosuppressive Drug Coverage

High-income beneficiaries who have only Part B immunosuppressive drug coverage (e.g., after a kidney transplant) face monthly premiums in 2026 that vary by income (MAGI). The base premium is $121.60. For MAGI above certain thresholds, IRMAA surcharges apply, pushing the premium up to:

$202.70/month for MAGI between $109,001–$137,000 (single filers)

$324.30/month for MAGI between $137,001–$171,000

$445.90/month for MAGI between $171,001–$205,000

$567.50/month for MAGI between $205,001–$500,000

$608.10/month for MAGI of $500,000 or more

For more detailed information on this coverage and the IRMAA brackets, see the CMS 2026 Medicare Parts A & B premiums fact sheet.

Medicare Part A Premium and Deductible

Medicare Part A provides coverage for inpatient hospital stays, skilled nursing facilities, hospice care, inpatient rehabilitation, and certain home health care services. Approximately 99% of Medicare beneficiaries do not pay a Part A premium because they have at least 40 quarters of Medicare-covered employment, as determined by the Social Security Administration.

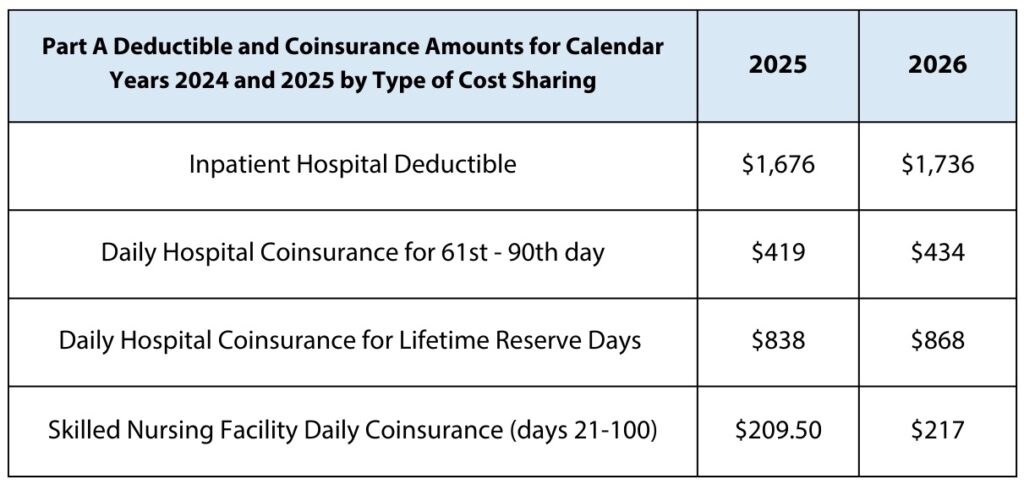

In 2026, the Part A inpatient hospital deductible (for each benefit period) will be $1,736, up $60 from $1,676 in 2025. This deductible covers the first 60 days of inpatient care in a benefit period. For days 61–90, beneficiaries will pay $434 per day (up from $419 in 2025), and for lifetime reserve days, they’ll pay $868 per day (up from $838).

For skilled nursing facility (SNF) care (extended care services), the daily coinsurance for days 21–100 in a benefit period will rise to $217 in 2026 (from $209.50 in 2025).

Part A Premium and Deductible

Enrollees age 65 and older who have fewer than 40 quarters of Medicare-covered employment — and certain persons with disabilities — pay a monthly premium to voluntarily enroll in Medicare Part A. In 2026, individuals with 30–39 quarters (or married to someone with that many) may “buy in” at a reduced premium of $311/month, up $26 from 2025. Those with fewer than 30 quarters (or certain uninsured aged individuals or disabled people who have exhausted other entitlements) pay the full premium of $565/month, a $47 increase from 2025.

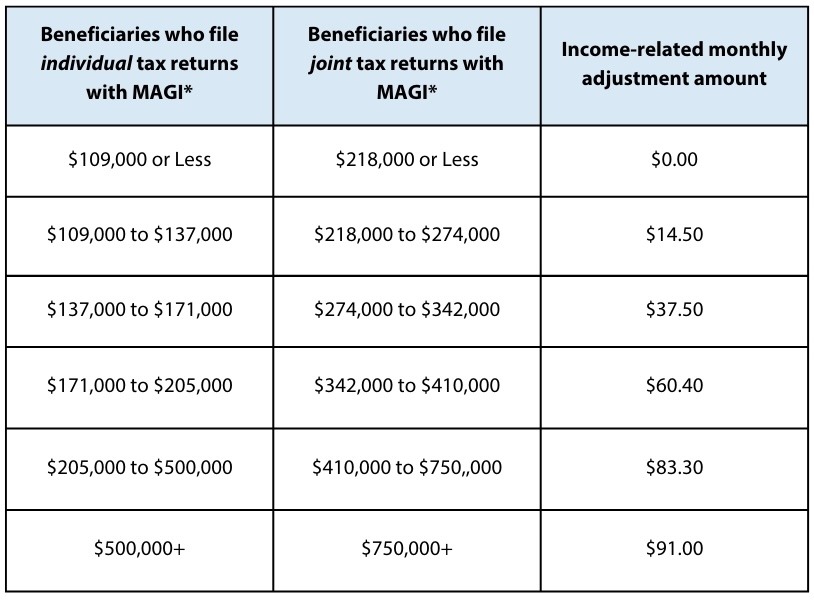

Medicare Part D Income-Related Monthly Adjustment Amounts

Since 2011, Medicare Part D monthly premiums have been determined based on a beneficiary’s income. Approximately 8% of Medicare Part D enrollees pay income-related monthly adjustment amounts (IRMAA) in addition to their standard Part D premium.

Part D premiums vary by plan, but regardless of payment method, IRMAA amounts are deducted directly from Social Security benefits or paid directly to Medicare. While about two-thirds of beneficiaries pay premiums directly to their plan, the rest have premiums deducted from their Social Security checks.

For 2026, the income-related monthly adjustment amounts for high-income beneficiaries are outlined in the table below.

Part D Premium and Deductible

Requesting a New IRMAA Determination or Appealing an IRMAA Decision

Many beneficiaries are assigned IRMAA based on income reported on tax returns from two years prior. If your current income is significantly lower due to life-changing circumstances, you may qualify to have IRMAA reduced or removed.

When You Can Request an IRMAA Reconsideration

You may request a new determination if you’ve experienced a qualifying life-changing event, including:

Marriage, divorce, or death of a spouse

Reduction in work hours

Loss of job or retirement

Loss of income-producing property

Reduction or loss of pension income

Employer settlement payment ending

If any of these apply, you can ask Social Security to review your current income rather than your past return.

How to Request a Reconsideration

You can submit a request to Social Security using Form SSA-44, along with documentation supporting your change in income.

Social Security will review the form and supporting documents to determine whether a lower IRMAA amount is justified based on your updated financial situation.

Next Steps After Filing

Once Social Security processes your request:

You will receive a new determination letter.

If approved, your IRMAA may be reduced or removed.

If denied, you still have the right to appeal through further reconsideration levels.

If you need help understanding IRMAA, determining eligibility for relief, or comparing Medicare plan options affected by IRMAA-related costs, our team at Medicare Mall is here to support you.